Fifth Industrial Revolution

Ancestors Speak

BUILDING CREATIVE SOCIAL CAPITAL

Creativity is on the minds of the TMT Youth Community Foundation because it provides the essential foundation for innovation. We learn what the research says about advancement of humanity and plan according. Our goal is to inspire creativity in you and provide program participants the supportive environment to thrive in the next industrial revolution.

Social capital is defined as “networks together with shared norms, values and understandings that facilitate co-operation within or among groups”. The TMT Youth Community Foundation accesses the world view then works as the backbone to networked businesses to build social capital in communities of color.

WORLD VIEW

With the constant threat of disruption and the accelerated lifecycles of products and services, companies have to think about problems and business issues in new ways. Maximizing efficiencies is no longer enough for continued growth. Businesses must get creative.

HISTORICAL INDUSTRIAL TRANSITIONS | GILDED AGE

Imagine a time of incredible economic expansion and wealth creation punctuated by periods of class warfare, strife and political upheaval. During the Gilded Age of the 1870s-1900 we saw all of these: rapid economic growth, wage growth, immigration and expansion of social programs like education with the standardization of primary schools and the emergence of high schools.The Gilded Age was a period of economic growth as the United States jumped to the lead in industrialization ahead of Britain. At the time, the major industry of growth was the railroads which in turn led to technological expansions in factories, mining and farming. The Gilded Age was a period of transformation in the economy, technology, government, and social customs of America. This transformation forged a modern, national industrial society out of what had been small regional communities. As is the case today, Wall Street played an important role during the Gilded Age as a financial intermediary and financed everything including a bubble in railroads which eventually burst. While this economic expansion was happening, immigrants fled to America in droves and a class division started to emerge with the 1% owning more than 25% of all property and the bottom 50% owning less than 4%.

If you replace ‘railroads’ with ‘technology’ and re-read these last few sentences, does any of this sound familiar?

AMERICA'S GLOBALIZATION & INTERNATIONAL PANDEMIC

When historians describe the period from 1980 to 2020, it will be recorded as the reckoning with the devaluation of the RMB to the US Dollar. Overnight, China’s currency became almost 40% more competitive and the West was flooded with an amazing production surplus. We were able to buy things made in China at a huge discount, so we bought more and more, building an insatiable demand of retail consumption.

This currency devaluation also had several advantages for China. With a large demographic bulge of young people, the government was able to put these hard working and ambitious people to work in all manner of factories. In turn, these factories were increasingly running 24 hours per day feeding the West’s insatiable appetite for consumption - and a virtuous cycle was born. China was then able to take the proceeds of this activity and invest heavily in its own infrastructure, running massive yearly GDP gains and eventually becoming the 2nd most important economy in the world.

Other Asian countries, joined the devaluation fun and by the turn of the century, we had seen an entire block of countries devalue their currency relative to the US Dollar further exacerbating the trade deficit/surplus between the West and Asia.

Companies in the West were not just incentivized to buy cheap Chinese goods, they also had a mechanism to export jobs to, and invest heavily in, China. All of this, as we know now, ultimately hollowed out the American middle class, created the Rust Belt, lit the fuse on the opioid crisis and enabled a resurgence of both left and right populism.

The kill shot to globalization came in 2016 with the election of President Trump - it was the disenchanted protest vote heard around the world.we were not allowed to be anything but positive about globalization until the pandemic.

During the pandemic, facing critical shortages of goods like PPE, it became clear that globalization had created a fragile ecosystem of dependency of Chinese goods. But the problem is that if each country was forced to be self-sufficient, it is akin to advocating for the Dark Ages. Instead, a more reasonable middle ground is a world where we value a handful of trading partners for critical resources, metals and supply chains versus just one. While no one country will get rich quickly under this model, and while it will likely be more inefficient and cause prices to rise, it will also allow many countries to create lots of middle class jobs for their populations (ie the circa 2000 China playbook but for everyone).

MEDIA

The modern media landscape before social media was about a few, trusted outlets that became the tastemakers for the broad majority of people. If you didn’t like the opinion of CBS News, you could always switch to ABC or NBC. There were a few outlets (NBC, CBS, ABC) that catalyzed opinions and views - and as long as they stayed relatively centered, not much could go wrong. At the same time, it also turned out that systemic injustices would continue to compound with no obvious way to shine a light on and fix them unless these three outlets decided to do so.

You can now find your own news, your own tribe, your own calling and feel validated in a way that wasn’t possible before. We have all become multi-faceted and diverse in our opinions with room and opportunity to explore the edge cases and think in nuanced ways. This has also meant that centralized tastemaking and narrative control are the least valuable it has ever been. For most people, the solution is in getting the facts, finding the middle ground, de-escalating the rhetoric, being open minded and listening to one another. The implications of all of this are vast and we are focused on how all of this may play out, particularly in the financial markets.

BLACK LIVES MATTER

We have allowed systemic racism and unconscious bias to affect how an entire class of people are treated - by the justice system, by the penal system, by the social welfare system, by the education system and the list goes on - because of the color of their skin. In no reasonable, moral worldview is this acceptable. While we all want to live in a world where stating the obvious isn’t necessary, this is what millions of people were forced to do throughout America in 2020. The overwhelming majority of BLM protests were just that - peaceful statements of disapproval about the status quo.

CLIMATE CHANGE

The effects of climate change continued unchallenged. In fact, per NASA, despite much less economic activity, 2020 was not only the warmest year on record, it added to a trend where now the last seven years have been the warmest seven years on record. At this rate, the impacts to the Earth’s biodiversity and resource scarcity (food, water) are unavoidable.

MARKETS

If 1980-2020 was about rampant globalization, then 2020-2060 will be a moderation of this dynamic. In part because of demographics. As we start 2021, there has been a meaningful shift in the demographics of the West vs Asia. Every two years, the median age in China increases by ~1 year. In America, we are roughly staying the same. As this has played out over time, the median ages of China and America have now become equal. But China will continue to age while America remains relatively young over the next few decades. The scale of this demographic shift means fewer young workers in China, increased domestic consumption by older Chinese citizens and the attendant infrastructure needs to deal with an aging population. As China lowers growth to deal with this trend, the impact on prices should see a reverse of the 1990s and 2000s. In other words, prices, in general, are more likely to go up than down for traditional commodities and goods.

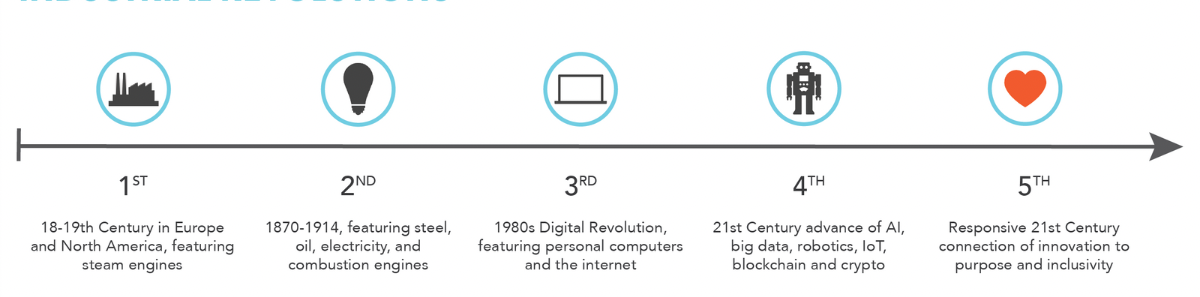

THE FIFTH INDUSTRIAL REVOLUTION- HUMANS AND TECHNOLOGY COMBINE

Many enterprises can now digitize once-manual and paper-based processes to achieve a digital enterprise.Some of today's leading internet-connected technologies are spurring a Fifth Industrial revolution

These technologies include:

- The internet of things (IoT)

- Cloud computing

- Big data

- Robotics and artificial intelligence (AI)

While this sounds good, many people are concerned that such a digital and system-centric business models are diminishing role of humans. Naturally, software and robotics have superseded humans on the assembly line because they can outpace them on repetitive tasks. But recent strides in AI and cognitive computing mean systems can exploit data to complete more complex functions, such as problem-solving, once believed to be the exclusive domain of the human mind.

Based on this, there is new demand for rare earths, battery metals, semiconductors, additive manufacturing and many other end markets, we believe we will see a resurgence of the American middle class and our manufacturing prowess.

- Suborbital space travel that can redefine geographies and shrink the gap of time and distance.

- 3D printing that can create a new manufacturing reality where precision and safety are a predictable output at low cost and any scale for both big businesses and startups.

- Cybersecurity products which can contribute reliable data protection and privacy by protecting important assets from bad actors.

- New chips for machine learning that can enable an entire generation of ambitious AI applications not even thinkable today.

- Bioinformatics that combine data, diagnostics and compute power to bend the cost curve of healthcare to deliver better care at lower costs.